Company’s core business is in the coal production and distribution domestically and overseas, having coal mine projects located in Indonesia as its base for coal production and distribution activities. In addition, the Company has ocean freight transport service business in Singapore to effectively support and manage coal transport for distribution in the Country or delivery to other countries.

Coal Characteristics

Coal is a fossil fuel composed of volatile matter, inherent moisture, and a combustible mixture of carbon. After combustion, when the volatile matter and inherent moisture have been driven out, a small portion of coal ash remains. Coal is classified into four grades based on its calorific value, volatile matter content, and fixed carbon composition, listed in descending order of quality as follows: (1) anthracite, (2) bituminous, (3) sub-bituminous, and (4) lignite. In Thailand, most indigenous coal deposits explored and developed for local industries are of lignite grade. Imported coal is primarily bituminous, which has a higher calorific value than domestically produced lignite.

Coal pricing is typically determined based on coal quality, which includes factors such as calorific value, moisture content, volatile matter, fixed carbon, ash content, sulfur content, and size.

Coal Production

Coal is formed in several stages from plant remains that have been compacted, hardened, chemically altered, and metamorphosed by heat and pressure over millions of years. Therefore, developing a coal mine requires coal exploration activities to collect and analyze geological data, which helps determine coal seam thickness, resource boundaries, chemical content and quality, and economic reserve estimations. The development of coal deposits is generally based on the information and data obtained from these exploration programs. Accordingly, coal production consists of three major steps as follows:

(1) Coal Exploration: The exploration process begins with the preliminary collection and analysis of land surface and geological data in the target areas. This is followed by fieldwork, including scout drilling, to examine the formation, composition of soil and rock, and geological structure of the area. The objective is to confirm the presence of coal deposits and conduct further quality assessments and reserve estimations to determine economic feasibility, supporting decision-making for further mine development.

(2) Coal Mining: Prior to coal mining operations, detailed drilling activities are conducted to collect and interpret necessary data on the mining areas, such as, coal reserves, coal quality, and soil layer composition for each coal seam formation. This data is used to develop the mine master plan, which includes cost analysis, mining methods, overburden removal and coal winning logistics, as well as the selection of suitable mining equipment and machinery.

(3) Coal Dressing: To meet customer and industry requirements, coal extracted from mining operations undergoes a coal dressing process, which includes crushing, sizing, sorting, and washing to remove impurities and contaminants, ensuring the final product meets the required quality standards.

Coal Pricing Policy

Coal pricing is mainly determined by its heating value, similar to other types of fuels. The coal sale price for each customer may vary based on several factors, including order volume, coal specifications such as calorific value, credit terms, and other specific conditions specified by customers. These factors are taken into account to ensure fair and consistent pricing for all customers. For imported coal, pricing is agreed upon with each customer and may be based on various terms, such as FOB (Free on Board), CIF (Cost, Insurance, and Freight), or delivered directly to the customer’s facility, depending on the mutually agreed conditions.

Coal Distribution

For domestic coal distribution, the Company sells directly to customers without using agents. In the overseas market, coal is sold either directly to customers or through coal trading agents, primarily on a credit-term basis. The Company carefully grants credit terms only to long-term customers with stable financial status. For new customers, the Company mitigates risk by requiring a letter of credit (L/C) issued by the customer. Since commencing operations in 1985, the Company has experienced minimal bad debt from coal sales.

Competitive Strategy

The Company prioritizes service and quality control of the coal products as its marketing strategy, rather than relying solely on pricing competitiveness. Additionally, the Company continuously enhances coal production processes by integrating modern technology to improve operational efficiency and product quality.

Competition

The domestic coal distribution business has been recognized as an oligopoly market, with a limited number of operators supplying both large and small industrial customers. The major competitor is Banpu Public Co., Ltd. Nevertheless, with ownership of high-quality coal mines and substantial mineable reserves, the Company maintains a strong competitive advantage and significant business potential.

Industrial Trend

Global coal demand increased by approximately 1 percent in 2024, reaching 8.771 billion metric tons, marking a new all-time high. In China, coal consumption increased by approximately 1 percent to 4.939 billion metric tons, and in India, it increased by approximately 5 percent to 1.315 billion metric tons. However, coal consumption in the European Union and the United States decreased by approximately 12 percent and 5 percent, respectively.

According to the latest report by the International Energy Agency (IEA), published in December 2024, global coal consumption has increased by 1.2 billion metric tons since 2020. Nevertheless, global coal demand is expected to plateau over the next three years and reach approximately 8.873 billion metric tons in 2027. While consumption in advanced economies is anticipated to decline steadily, emerging and developing economies, particularly India, Indonesia, and Vietnam, is expected to see significant increases in coal consumption. This growth is driven by economic expansion and rising energy demand, with these countries offsetting the decline in more advanced economies, as mentioned above.

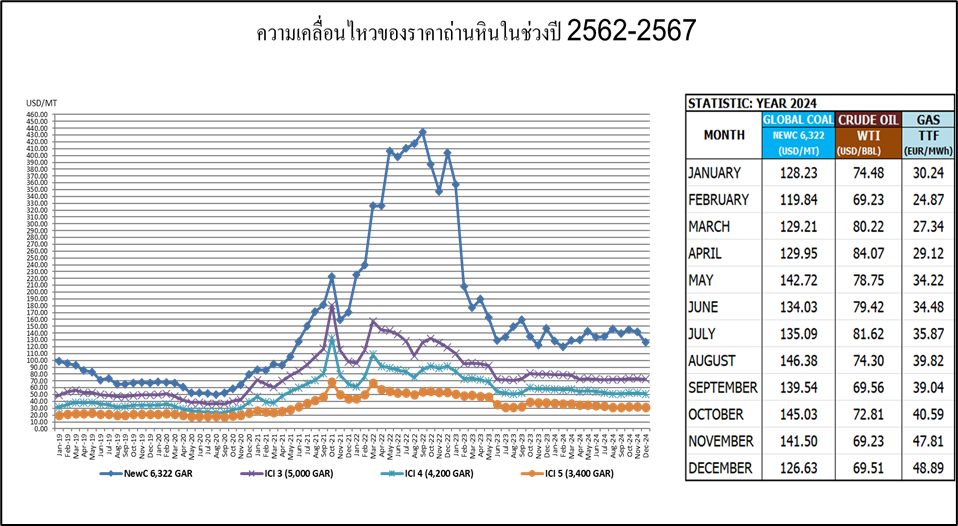

Regarding price trends, market direction, and movements, the focus will be on monitoring and assessing circumstances related to China, which plays a dominant role in the global coal market as the world’s largest energy consumer. China accounts for approximately 56 percent of global coal consumption, with domestic production of 4.653 billion metric tons, or nearly half of the world’s total coal output. Additionally, China imports approximately 525 million metric tons of coal, representing a significant portion of international trade, which totals1.546 billion metric tons. Of this, approximately 235 million metric tons are imported from Indonesia, out of Indonesia’s total coal exports of 557 million metric tons.

Coal prices in 2025 are expected to align with market conditions observed from mid-2024 to present, based on current economic fundamentals. Several key factors require continuous monitoring and assessment, including the economic recovery of major economies such as China, sustained economic growth of India, geopolitical developments, trade restrictions, supply constraints, production costs, environmental concerns, the impact of coal mining operations, policies and regulations implemented by major coal-producing countries, particularly China, India, and Indonesia. Moreover, the increasing severity of climate change, energy security concerns, and global efforts to transition towards lower-carbon energy sources will impact market dynamics. Many countries are currently in the process of restructuring their energy portfolios to reduce carbon emissions by increasing the proportion of renewable and alternative energy sources. All these factors will contribute to market volatility.

COAL BUSINESS ACTIVITIES

Domestic Coal Business

The Company imports coal from its joint venture coal mining projects as well as from other sources in Indonesia for distribution in Thailand by either direct delivery and for inventory and processing before delivery to the customers at the Ayutthaya Coal Distribution Center, located in Nakhon Luang District, Phra Nakhon Si Ayutthaya Province, on an area of 31 rai and 56.40 square wah, which can accommodate over 200,000 metric tons of coal inventory. In 2024, the Company’s domestic coal market share was approximately 10 percent of total coal consumption in the industrial sector, excluding coal used for electricity generation by Independent Power Producers (“IPP”) and Small Power Producers (“SPP”). The cement industry accounted for approximately 34 percent of domestic coal consumption in 2024, with the remaining 66 percent consumed by electricity generation and other industries, excluding electricity generated by the Electricity Generating Authority of Thailand (“EGAT”). As coal has a lower cost per heat unit compared to other fuel types, domestic coal consumption is expected to continue increasing in the future.

Overseas Coal Business

For over 22 years, the Company has invested in joint venture coal mining projects in Indonesia, with coal produced from these projects imported for domestic distribution in Thailand as well as exported to international markets, particularly across the Asia region, including India, Japan, South Korea, Taiwan, and Hong Kong. The Company’s coal products are recognized for their high quality and are wellestablished under a reputable brand, earning the trust of both domestic and international customers. As a result, the Company is regarded as one of the highly reliable coal suppliers in the Asia region.

PT. Lanna Harita Indonesia (“LHI”), a subsidiary registered in Indonesia, in which Lanna Resources Public Co., Ltd. directly holds 55 percent of the paid-up capital, operates coal mining business in Samarinda District, Kutai Regency, East Kalimantan, having received a Coal Contract of Work (“CCoW”) from the Indonesian Government for coal production and distribution for a period of 30 years (from 2001 to 2031). The remaining coal reserves are estimated at no less than 18 million metric tons. In 2024, LHI produced and sold approximately 3.5 million metric tons of coal, with plans to maintain annual production and sales volume at approximately 3.5 million metric tons in the following years.

PT. Singlurus Pratama (“SGP”) a subsidiary registered in Indonesia, in which Lanna Resources Public Co., Ltd. directly holds 65 percent of the paid-up capital, operates coal mining business in Kutai Regency, East Kalimantan, having received a Coal Contract of Work (“CCoW”) from the Indonesian Government for coal production and distribution for a period of 30 years (from 2009 to 2039). The remaining coal reserves are estimated at no less than 33 million metric tons. In 2024, SGP produced and sold approximately 5 million metric tons of coal and is currently developing a new coal deposit within its coal mining concession area, known as the Margomulyo Block (“MG”). Coal production and distribution from MG commenced in the 3rd quarter of 2024 with approximately 1.5-2.0 million metric tons per year. Coal produced from MG will be transported via the port and jetty of the Argosari Block (“AG”), which is currently in operation. SGP has increased its production capacity by constructing a second coal processing plant and renovating the coal stockyard areas to increase coal stockpile capacity to 200,000 metric tons, and has completed the renovation of its port and jetty, as well as installed an additional 1.70-kilometer conveyor belt extending from the port to the offshore jetty in order to accommodate coal production and distribution from the AG and MG blocks. SGP plans to produce and distribute approximately 5 million metric tons of coal in 2025, with an expected annual production volume of approximately 4.5 million metric tons per year in subsequent years. The coal produced is high-quality, with high calorific value and low sulphur content, which is expected to be well received in the market and generate favorable profit margins.

PT. Pesona Khatulistiwa Nusantara (“PKN”) a subsidiary registered in Indonesia, in which Lanna Resources Public Co., Ltd. directly holds 10 percent of the total number of shares, operates coal mining business in Bulungan Regency, North Kalimantan, having received a Coal Contract of Work (“CCoW”) from the Indonesian Government for coal production and distribution for a period of 30 years (from 2009 to 2039). The remaining coal reserves from the Company’s two main coal sources are estimated at no less than 125 million metric tons. In 2024, the Company’s coal production capacity was approximately 5.5 million metric tons, with a production and sales plan of approximately 5.5 million metric tons for 2025.

United Bulk Shipping Pte. Ltd. (“UBS”), an associated company registered in Singapore, in which Lanna Resources Public Co., Ltd. directly holds 49 percent of the paid-up capital, was established to operate ocean freight transport and coal trading business. UBS has effectively managed coal transport services for imported coal to Thailand as well as coal distribution to other countries, ensuring cost efficiency and reliable service.